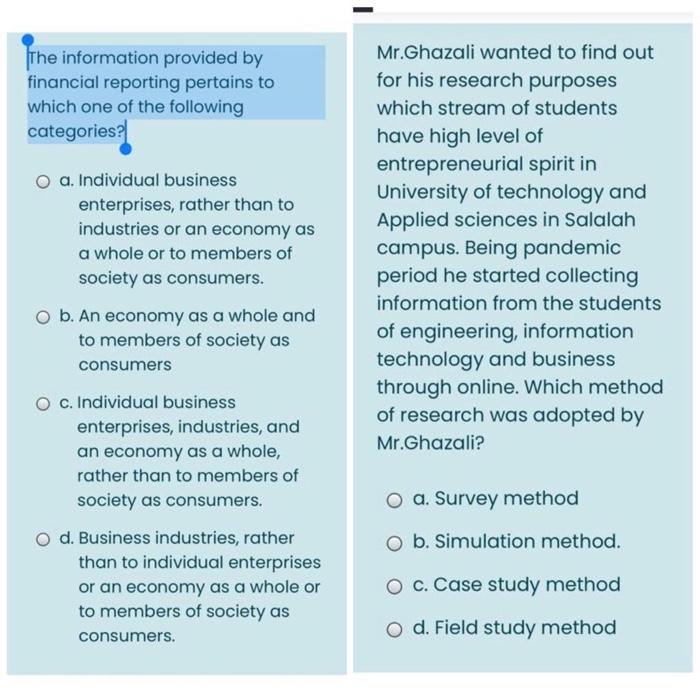

Financial information that depicts the economic substance of business activities – Financial information serves as a crucial tool in deciphering the economic substance of business activities, providing valuable insights into a company’s financial health, performance, and underlying operations. This information encompasses various financial statements, each with a distinct purpose and composition, that collectively paint a comprehensive picture of a business’s financial landscape.

The balance sheet, income statement, and cash flow statement form the cornerstone of financial reporting, offering a detailed snapshot of a company’s assets, liabilities, equity, revenues, expenses, and cash flows. These statements, when analyzed in conjunction, provide a comprehensive understanding of a business’s financial position and performance over a specific period.

Financial Statements

Financial statements provide insights into the economic substance of business activities by summarizing a company’s financial position and performance. The three primary financial statements are the balance sheet, income statement, and cash flow statement.

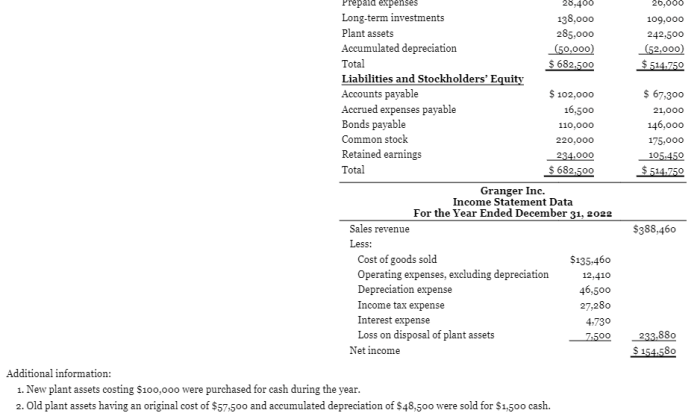

- Balance Sheet: Provides a snapshot of a company’s financial health at a specific point in time, showing its assets, liabilities, and equity.

- Income Statement: Reports a company’s revenues, expenses, and profits over a period of time, showing its profitability.

- Cash Flow Statement: Tracks the flow of cash and cash equivalents into and out of a company, providing insights into its liquidity and solvency.

Balance Sheet, Financial information that depicts the economic substance of business activities

The balance sheet presents a company’s assets, liabilities, and equity as of a specific date. Assets are resources owned by the company, liabilities are obligations owed to others, and equity represents the residual interest in the company’s assets. The balance sheet equation, Assets = Liabilities + Equity, must always hold true.

Income Statement

The income statement reports a company’s revenues, expenses, and profits over a period of time. Revenues are the income generated from the sale of goods or services, expenses are the costs incurred in generating revenue, and profits are the excess of revenues over expenses.

The income statement shows a company’s profitability over a specific period.

Cash Flow Statement

The cash flow statement reports the flow of cash and cash equivalents into and out of a company. It is divided into three sections:

- Operating Activities: Cash generated or used in the company’s core operations.

- Investing Activities: Cash used to acquire or sell long-term assets.

- Financing Activities: Cash used to raise capital or repay debt.

The cash flow statement provides insights into a company’s liquidity and solvency.

Financial Ratios

Financial ratios are mathematical relationships that compare different financial statement items. They can be used to assess a company’s profitability, liquidity, solvency, and other aspects of its financial performance. Common financial ratios include:

- Profitability ratios: Measure a company’s ability to generate profits.

- Liquidity ratios: Measure a company’s ability to meet its short-term obligations.

- Solvency ratios: Measure a company’s ability to meet its long-term obligations.

Financial ratios can be used to compare companies within the same industry and to identify trends over time.

Non-Financial Information

Non-financial information, such as industry analysis and market research, can also provide insights into the economic substance of a business. Industry analysis provides an understanding of the competitive landscape and trends in a company’s industry, while market research provides insights into customer needs and preferences.

Non-financial information can be used to supplement financial data and provide a more comprehensive understanding of a company’s business.

Quick FAQs: Financial Information That Depicts The Economic Substance Of Business Activities

What are the key components of a balance sheet?

The balance sheet comprises three primary components: assets, liabilities, and equity. Assets represent the resources owned by the company, liabilities represent its obligations, and equity reflects the residual interest of the owners.

How does the income statement differ from the balance sheet?

The income statement focuses on a company’s revenues and expenses over a specific period, providing insights into its profitability. In contrast, the balance sheet offers a snapshot of a company’s financial position at a specific point in time.

What is the significance of cash flow in evaluating a business?

Cash flow analysis assesses a company’s ability to generate and utilize cash, which is crucial for its day-to-day operations, debt repayment, and investment decisions.